I’m voting for Joe Ferris for Mayor of Hudson.

I’ve been on the City of Hudson’s Common Council for almost two years, and this is why I’m voting for Joe Ferris for Mayor:

Mill Street Lofts Project

The Mill Street Lofts, a proposed housing project on Mill Street in the fourth ward, should not happen. Here’s my letter to the Planning Board in opposition. Joe Ferris also opposes the project. This project had zero initial input from the community. What should have happened, similar to other houses on Mill Street, is a partnership with a small non-profit group such as Columbia Greene Habitat for Humanity, to help people purchase their first home and build generational wealth. Large public housing projects financially benefit the developers leaving many in public housing for a lifetime. I’m very disappointed that our current Hudson administration cozies up to large developers.

The Planning Board

If you have watched Planning Board meetings, you’ve seen the overall dysfunction. Projects such as Mill Street Lofts get fast-tracked while other projects are mired in red tape and studies. The Planning Board is reluctant to put any restrictions or conditional uses on the gravel trucks or barges on waterfront. In January, the (new) Mayor can appoint new members to the Planning Board. Appointments to the Planning Board are solely the responsibility of the Mayor. This the number one reason I’m voting for Joe Ferris – we need new appointees to the Planning Board.

Property Taxes

In November 2024, as Chair of the City’s Finance Committee, I asked our City Treasurer about back property taxes. We learned the City has about $3M in unpaid property taxes. At the time, the City did not have a lawyer assigned to the issue. Fifth Ward City Councilmember Vicky Daskaloudi found a legal team to represent the City. The City is now pursuing back payments.

Property tax revenue is included in the City’s budget and the City assumes the taxes will be paid. The fees and interest on unpaid property taxes can be considered additional revenue, but the taxes themselves are already budgeted, or theoretically spent. Revenue from back property taxes do not fill our annual budget gap, since they are already part of the calculation.

The Mayor, in the last debate, talked about “relief” to those who did not pay their property taxes. Where does this relief come from? Who will pay it? The state? The federal government? If homeowners who fail to pay their taxes get relief, then why should anyone pay their taxes?

As a reminder, death and taxes are two things you cannot avoid…

The Budget

I’ve been chided multiple times by colleagues for raising a red flag about the City’s budget.

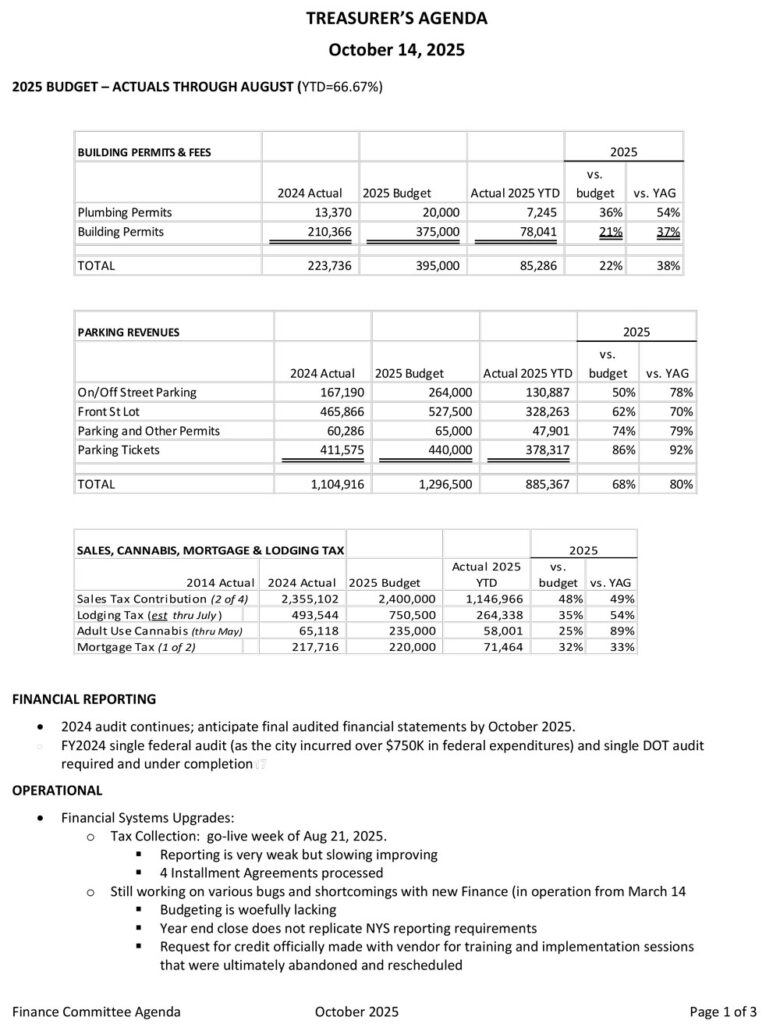

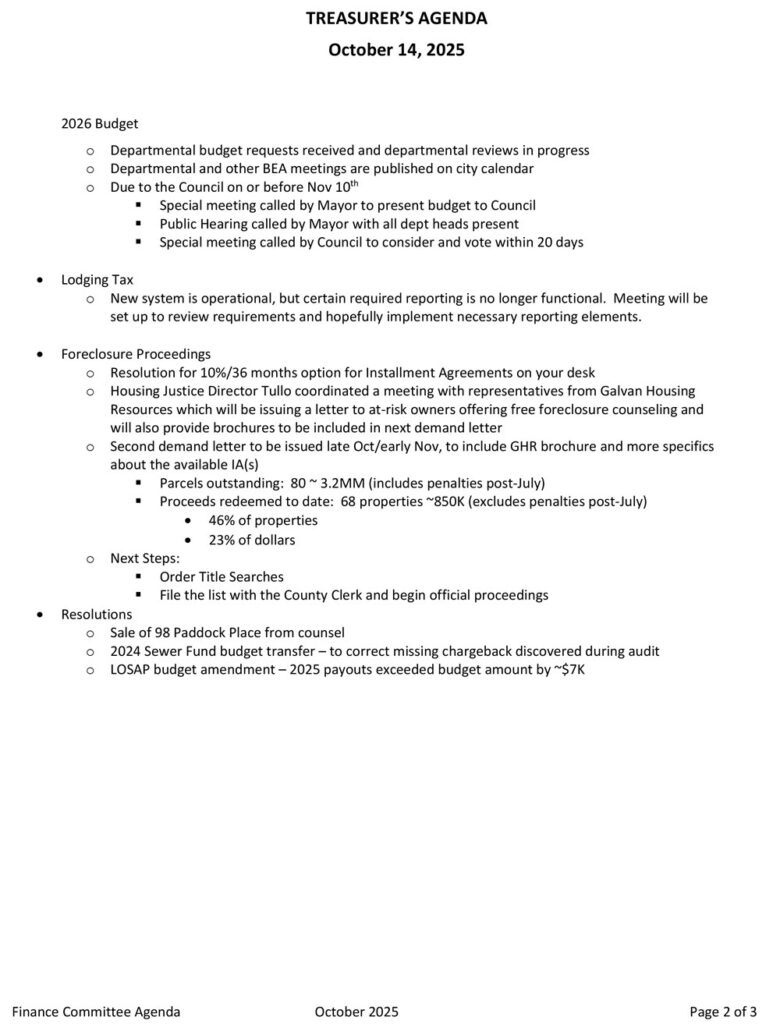

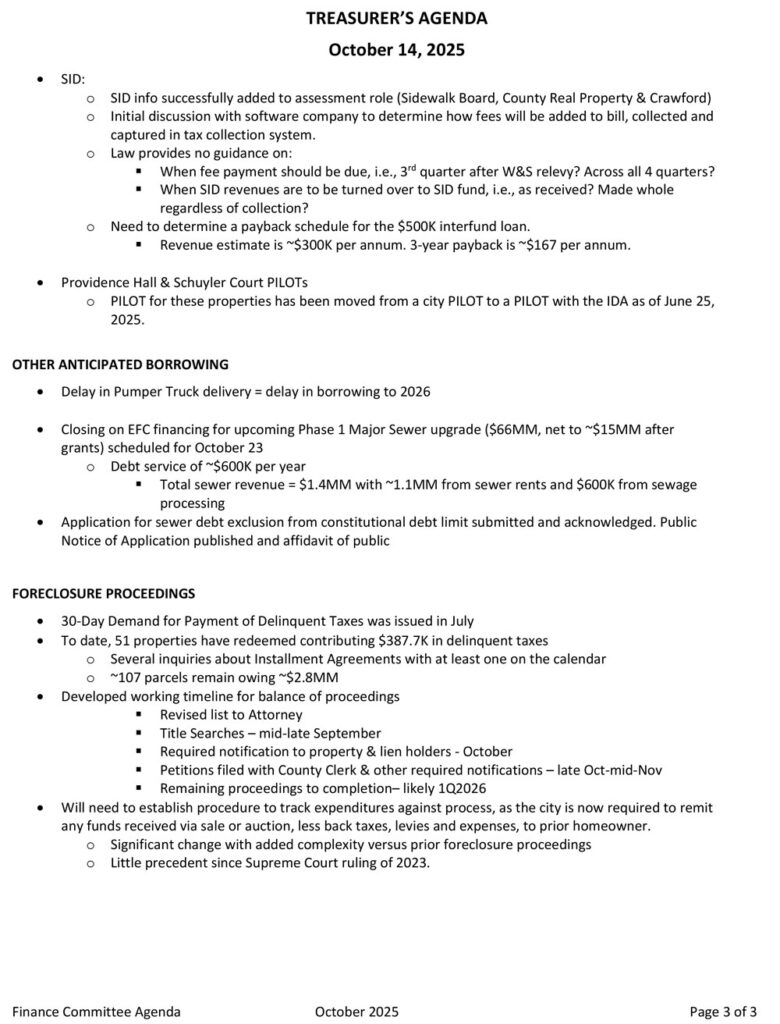

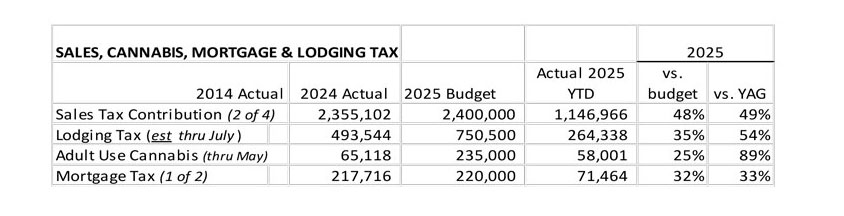

This is the last Treasurer’s report from October 2025:

On page one, please note our 2025 Budgeted versus Actual 2025 YTD numbers:

The 2025 budget was based on the expectation that additional lodging establishments would be open and collecting revenue, however that did not happen. Cannabis revenue (thru May) also did not meet expectations.

Last year, Councilmember Morris and I voted against the budget. I felt $800K from the Fund Balance, or “rainy day” fund, was not a good way to offset the budget gap.

The City’s 2026 budget process is currently underway. I am interested to see how the City’s BEA – Board of Estimate and Apportionment (the Mayor, Council President, and Treasurer) offset this year’s increases in expenses with decreases in revenue, and with less funds in reserve.

We need a mayor who works with our local business community, and does not deride it.

Early Voting starts Saturday, October 25th. You can find the schedule here.

Please vote for change. Please vote Joe Ferris for Mayor.

Thank you,

Rich “Trixie” Volo